Understanding “Tarik Tunai Dompet Elektronik”: A Complete Guide to E-Wallet Withdrawals

Introduction

In the era of digital payments, e-wallets have become an essential tool for both consumers and businesses. One key feature of electronic wallets is the ability to make withdrawals, commonly referred to as “tarik tunai dompet elektronik” (e-wallet cash withdrawal). This feature allows users to convert their digital balance into physical cash, which can then be used for everyday transactions. In this guide, we will explore what tarik tunai dompet elektronik is, how it works, its advantages, and the various e-wallets offering this feature.

What is Tarik Tunai Dompet Elektronik?

“Tarik tunai dompet elektronik” refers to the process of withdrawing money from an electronic wallet to be used as physical cash. E-wallets are digital platforms that store users’ money and allow them to make payments, transfer funds, and more. Tarik tunai is a term used in Indonesia, which directly translates to “cash withdrawal.”

With tarik tunai dompet elektronik, users can transfer their e-wallet balance to their bank accounts or withdraw the money at supported ATMs. This feature is becoming increasingly popular as people rely more on electronic wallets for their daily financial transactions.

How Tarik Tunai Dompet Elektronik Works

To perform tarik tunai dompet elektronik, users must first have an active e-wallet account and a sufficient balance. Depending on the platform, the process for withdrawal may vary slightly, but generally, it involves the following steps:

- Log into your e-wallet account: Open the e-wallet app and log in using your credentials.

- Select “Withdraw” or “Tarik Tunai”: This option can usually be found in the main menu or under the “Balance” section.

- Enter withdrawal amount: Specify the amount you wish to withdraw.

- Choose a bank account or ATM withdrawal: Depending on the e-wallet provider, you may either choose to transfer the funds to your linked bank account or select an ATM option.

- Confirm transaction: Review the details and confirm your withdrawal request.

- Complete the transaction: For ATM withdrawals, visit the ATM machine and follow the prompts to withdraw your cash.

Popular E-Wallets Offering Tarik Tunai Dompet Elektronik

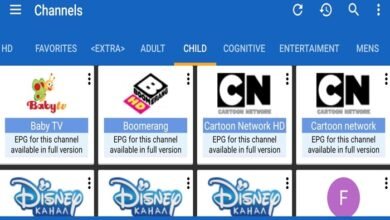

Several e-wallet platforms provide tarik tunai dompet elektronik services, each with its own set of features, fees, and withdrawal limits. Some of the most well-known e-wallets in Indonesia that offer this service include:

OVO

OVO allows users to withdraw cash from their e-wallet to their bank accounts or through participating ATMs. The withdrawal process is simple and fast, making it a convenient option for those who need physical cash from their digital balance.

GoPay

GoPay, another leading e-wallet service, also supports tarik tunai dompet elektronik. Users can transfer their GoPay balance to a bank account or withdraw it through ATMs, depending on their preferences.

DANA

DANA users can access tarik tunai dompet elektronik through ATM withdrawals or bank transfers. This platform offers a wide range of services, including bill payments and money transfers, making it a versatile option for users.

LinkAja

LinkAja is another prominent e-wallet in Indonesia that enables tarik tunai dompet elektronik. It offers both bank transfers and ATM withdrawals, catering to a wide audience.

The Benefits of Tarik Tunai Dompet Elektronik

There are numerous benefits to using tarik tunai dompet elektronik. Below are the most prominent advantages:

Convenience

With tarik tunai, users no longer have to visit a physical bank to withdraw cash. E-wallets allow for quick and convenient access to funds, especially in emergencies or when digital payments are not accepted.

Fast Transactions

Unlike traditional bank transfers, which can take time to process, tarik tunai transactions are usually completed within minutes. This quick service is especially beneficial when you need cash urgently.

Flexibility

Many e-wallets support multiple withdrawal methods, including bank transfers and ATM withdrawals. This gives users the flexibility to choose the method that suits them best.

Enhanced Security

E-wallets often come with robust security features, such as encryption and two-factor authentication, making tarik tunai dompet elektronik transactions safer than traditional methods.

Tarik Tunai Dompet Elektronik Fees and Limitations

While tarik tunai dompet elektronik is convenient, it may come with certain fees and limitations. These can vary depending on the e-wallet provider and the method chosen for withdrawal. Common fees and limitations include:

Withdrawal Fees

Some e-wallet platforms charge a fee for withdrawing money. This could be a fixed amount or a percentage of the total withdrawal amount. For example, some e-wallets charge a nominal fee for ATM withdrawals or a flat-rate fee for transferring funds to a bank account.

Withdrawal Limits

There may be limits on how much money you can withdraw per transaction or within a certain period. These limits are often set for security reasons and can vary between e-wallet providers.

ATM Availability

For ATM withdrawals, the availability of supported ATMs can be a limitation. Some e-wallets have partnerships with specific ATM networks, meaning you may need to search for a participating machine.

Comparing Tarik Tunai Dompet Elektronik Across E-Wallet Providers

To help you make an informed decision, it’s essential to compare the tarik tunai dompet elektronik options offered by various e-wallets. Consider the following factors when choosing the best platform for your needs:

- Fees: Compare the fees charged for withdrawals. Some platforms may have lower fees, especially for bank transfers.

- Limits: Look at the withdrawal limits, as these can affect how much you can access at once.

- ATM Network: If you prefer withdrawing cash from an ATM, check if the e-wallet is compatible with a wide network of ATMs.

- User Experience: Evaluate the ease of use of the e-wallet app. A user-friendly interface can make the withdrawal process much smoother.

Future Trends in Tarik Tunai Dompet Elektronik

The future of tarik tunai dompet elektronik looks promising, with continuous advancements in technology and digital payment systems. As more people adopt e-wallets, we can expect improvements in the speed, security, and accessibility of withdrawal services. Some potential future trends include:

- Integration with more payment networks: E-wallets may expand their partnerships with ATMs and bank networks, offering greater convenience for users.

- Enhanced security features: With the growing concern over digital security, e-wallet providers are likely to introduce more advanced measures to protect withdrawal transactions.

- Faster withdrawal times: As technology improves, we can expect even faster withdrawal processes, making tarik tunai more efficient than ever.

Conclusion

Tarik tunai dompet elektronik is a valuable feature for anyone who uses e-wallets. It offers a quick, secure, and convenient way to access physical cash when needed. Whether you’re withdrawing money from an ATM or transferring it to a bank account, e-wallets make it easier than ever to manage your finances. While there are fees and withdrawal limits to consider, the benefits of tarik tunai far outweigh the drawbacks. As e-wallets continue to grow in popularity, we can expect more innovations in this space, making digital cash withdrawals even more accessible.

FAQs

- What e-wallets support tarik tunai dompet elektronik? Some popular e-wallets offering tarik tunai include OVO, GoPay, DANA, and LinkAja.

- How long does it take to complete a tarik tunai dompet elektronik transaction? Typically, the process is quick, taking just a few minutes, depending on the method chosen (ATM withdrawal or bank transfer).

- Are there fees for tarik tunai dompet elektronik? Yes, some e-wallets charge a fee for withdrawals. The fee may vary depending on the platform and withdrawal method.

- Can I withdraw cash from any ATM? Not all ATMs support e-wallet withdrawals. Check if your e-wallet provider has partnerships with specific ATM networks.

- Is tarik tunai dompet elektronik secure? Yes, e-wallet platforms use encryption and other security measures to protect withdrawal transactions. Be sure to enable two-factor authentication for added security.